Break-Even Point Formula, Methods to Calculate, Importance

Investors reach the breaking point when the original cost and the market price of the asset are the same. When the market price increases, that’s when investors earn profit. The following table shows current rates for savings accounts, interst bearing checking accounts, CDs, and money market accounts.

Break Even Revenue Calculator

- If you need to stay out of town for a business-related trip, take advantage of credit card reward points.

- A break-even analysis allows you to determine your break-even point.

- Enter your values above and calculate your break-even point now.

- The SBA offers several different loan programs, such as 504 loans, 7(a) loans, and microloans.

It’s ideal for business owners that have good credit and are looking to expand their company. As mentioned earlier, determining your BEP can help you secure loans or persuade investors for your business. There are many various types of small business loans entrepreneurs can look into.

What is a break even analysis?

The break-even point is the volume of activity at which a company's total revenue equals the sum of all variable and fixed costs. One business's fixed costs could be another business's variable cost. If your company has an accountant under a monthly retainer, your analysis should consider the retainer fee as a fixed cost.

The BEP (Units To Break Even)

A break even point could be an ongoing target, say 20 units per week. This provides motivation to work toward your goals and forms a Key Performance Indicator (KPI) that your sales and operations teams can use as a tangible benchmark for success. People appreciate things that add value to their life and experiences. Thus, try to offer classes or workshops related to your business. If you’re in the printing business, host a talk about independent publishing for young writers. You can rent a venue at educational institutions such as a community college.

Effective Marketing Strategies to Boost Sales

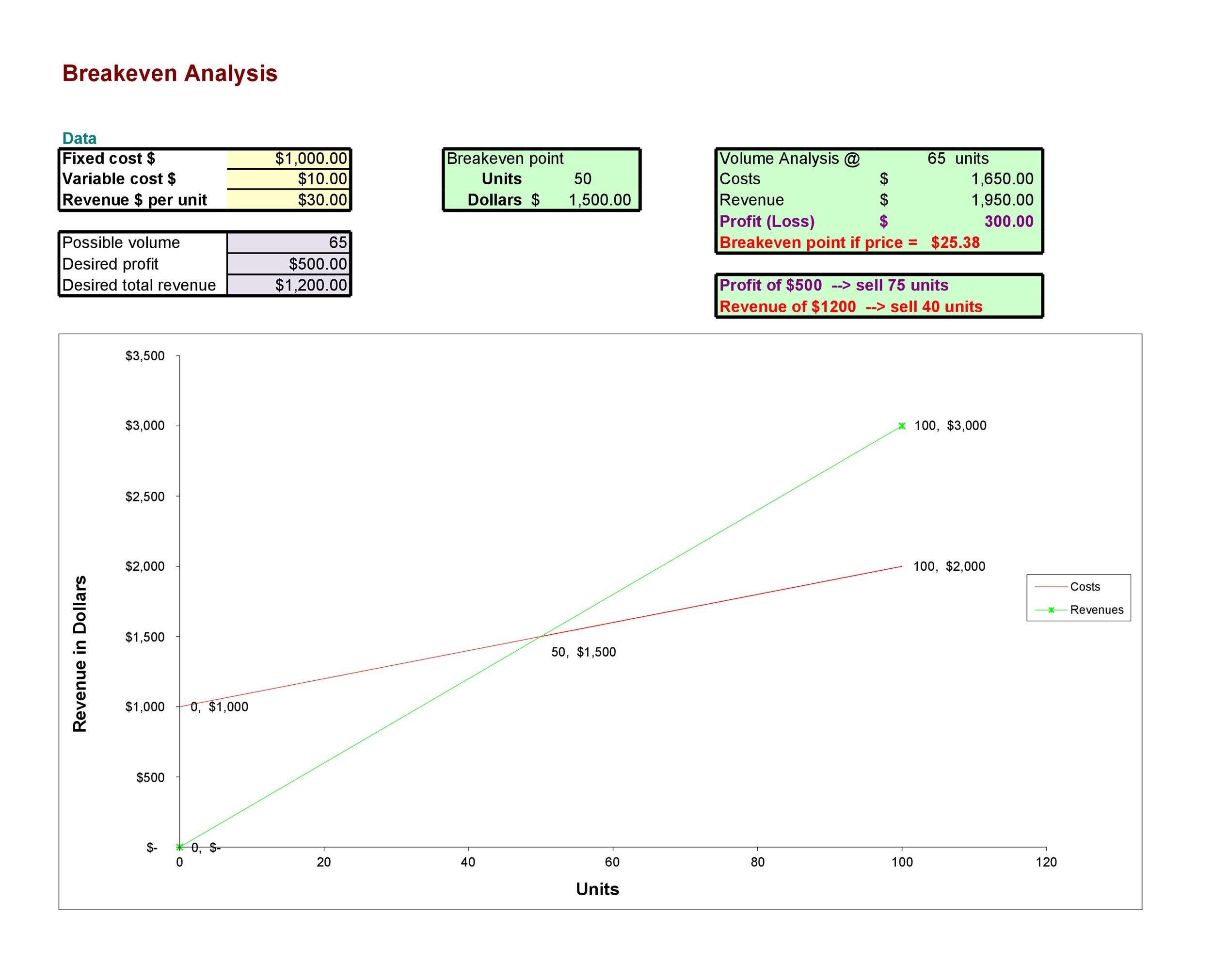

Divide fixed costs by the revenue per unit minus the variable cost per unit. The fixed costs are those that do not change, no matter how many units are sold. Revenue is the price for which you’re selling the product minus the variable costs, like labor and materials. The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product. Our guide will discuss the fundamentals of the break even point and how to calculate this financial benchmark. We’ll talk about different factors that impact breaking even, such as fixed and variable costs.

The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit. So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00. It’s one of the biggest questions you need to answer when you’re starting a business. There are two main business factors that impact BPE, these are fixed costs and variable costs.

No, the break-even point cannot be used to predict future profits. It is only useful for determining whether a company is making a profit or not at a given point in time. In order to calculate your break even point (the point where your sales cover all of your expenses), you will need to know three key numbers. If you entered the average price per trip and entered all your expenses as expenses per week, for you, the BEP is the number of trips you must make per week.

So to break even, Maria needs to create and sell eight quilts a month. If she wants to turn a profit, she'll need to sell at least nine quilts a month. If a company has reached its break-even point, the company is operating at neither a net loss nor a net gain (i.e. “broken even”).

The break-even analysis calculator is designed to demonstrate how many units of your product must be sold to make a profit. Hit “View Report” to see a detailed look at the profit generated at each sales volume level. Increasing Customer Sales – When there’s higher demand, a business must produce more microsoft 365 developer podcast of its products. To meet the higher demand volume, you need to cover larger production expenses. As a result, increasing sales also raises your BEP because you spend for extra expenses. Whether you have a large or small company, analyzing the break even point is a crucial part of business finance.

For example, your break-even point formula might need to be accommodate costs that work in a different way (you get a bulk discount or fixed costs jump at certain intervals). Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. Let’s say you’re trying to determine how many units of your widget you need to produce and sell to break even. The break-even point (BEP) is the point at which the costs of running your business equals the amount of revenue generated by your business in a specified period of time. In other words, your company is neither making money nor losing it.

Break-even analysis, also known as break-even point analysis, involves calculating the point at which a business breaks even and what steps it might take to become profitable. If you find yourself asking these questions, it’s time to perform break-even analysis. Read on to learn all about how break-even analysis can serve your small business. In conclusion, just like the output for the goal seek approach in Excel, the implied units needed to be sold for the company to break even come out to 5k.

Komentariši